Grunnleggende statistikk

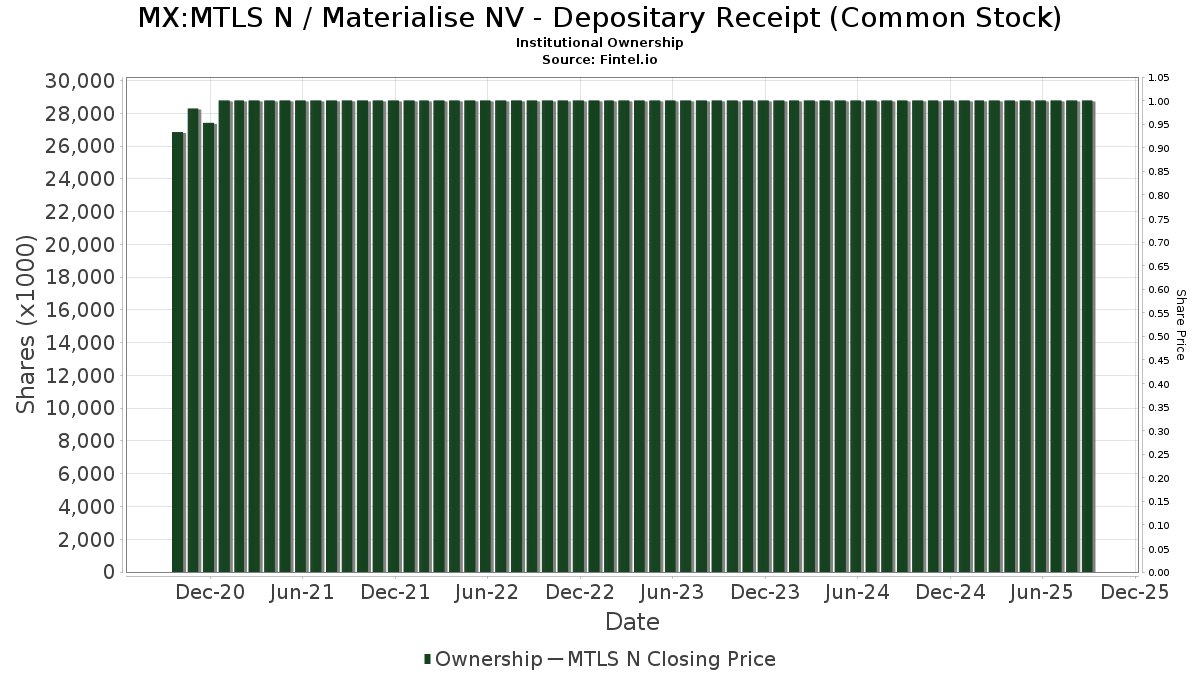

| Institusjonelle eiere | 72 total, 67 long only, 0 short only, 5 long/short - change of 10,96% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.3765 % - change of 6,20% MRQ |

| Institusjonelle aksjer (Long) | 8 732 934 (ex 13D/G) - change of 1,93MM shares 7,18% MRQ |

| Institusjonell verdi (Long) | $ 44 769 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Materialise NV - Depositary Receipt (Common Stock) (MX:MTLS N) har 72 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 8,732,934 aksjer. De største aksjonærene inkluderer Disciplined Growth Investors Inc /mn, Rock Point Advisors, LLC, PRNT - The 3D Printing ETF, King Luther Capital Management Corp, ARK Investment Management LLC, Acadian Asset Management Llc, Arrowstreet Capital, Limited Partnership, Wells Fargo & Company/mn, Renaissance Technologies Llc, and Renaissance Group Llc .

Materialise NV - Depositary Receipt (Common Stock) (BMV:MTLS N) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 34 | 0 | ||||||

| 2025-04-10 | 13F | Retireful, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Ballentine Partners, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Aperture Investors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | MAKX - ProShares S&P Kensho Smart Factories ETF | 3 235 | 170,03 | 17 | 112,50 | ||||

| 2025-07-16 | 13F | Randolph Co Inc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 580 000 | 19,59 | 3 277 | 37,34 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 17 527 | 0,00 | 99 | 15,12 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 53 518 | −13,25 | 288 | −11,11 | ||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 5 103 | 5,63 | 29 | 21,74 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 49 | 81,48 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 60 | 0,00 | 0 | |||||

| 2025-05-14 | 13F | Credit Agricole S A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 5 575 | −61,09 | 31 | −55,71 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 77 714 | −3,92 | 439 | 10,58 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 12 995 | 0,00 | 73 | 15,87 | ||||

| 2025-08-14 | 13F | Axa S.a. | 126 066 | 0,00 | 712 | 14,84 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 843 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4 231 | −48,38 | 24 | −42,50 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 24 890 | −74,87 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 502 640 | −2,93 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 30 700 | −10,23 | 173 | 2,98 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 54 | −65,82 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 28 993 | −46,09 | 164 | −38,26 | ||||

| 2025-08-14 | 13F | Rock Point Advisors, LLC | 981 515 | 9,28 | 5 546 | 25,51 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 48 500 | 80,97 | 274 | 109,16 | |||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 467 276 | 15,15 | 2 640 | 32,26 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 12 654 | 71 | ||||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 6 532 | 37 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 11 650 | 1 453,33 | 66 | 2 066,67 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 49 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 58 259 | 79,30 | 329 | 106,92 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 26 066 | −0,37 | 147 | 14,84 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 13 031 | 19 063,24 | 74 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 150 | 0,00 | 0 | |||||

| 2025-05-12 | 13F | EAM Global Investors LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 44 915 | −21,98 | 254 | −10,60 | ||||

| 2025-08-13 | 13F | Archon Capital Management LLC | 67 583 | 382 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 207 382 | −13,62 | 1 172 | −0,85 | ||||

| 2025-03-25 | NP | EAISX - Parametric International Equity Fund Investor Class | 9 400 | −38,56 | 79 | −13,33 | ||||

| 2025-08-08 | 13F | KBC Group NV | 212 932 | −0,68 | 1 | 0,00 | ||||

| 2025-08-28 | NP | SPDW - SPDR(R) Portfolio Developed World ex-US ETF | 8 595 | 2,11 | 49 | 17,07 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 25 900 | 146 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 96 400 | −66,86 | 545 | −61,98 | |||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 67 084 | 103,42 | 379 | 133,95 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 74 500 | 5,97 | 421 | 21,74 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 19 700 | −67,33 | 111 | −62,50 | |||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 314 300 | 0,06 | 1 776 | 14,89 | ||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 81 221 | 459 | ||||||

| 2025-08-14 | 13F | Bnp Paribas | 375 | 2 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 149 783 | 7,44 | 846 | 23,50 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 130 | 0,00 | 1 | |||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 1 700 | 0,00 | 10 | 12,50 | ||||

| 2025-04-22 | NP | GINN - Goldman Sachs Innovate Equity ETF | 9 868 | 52 | ||||||

| 2025-08-28 | NP | NDOW - Anydrus Advantage ETF | 8 820 | 18,29 | 50 | 36,11 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-29 | 13F | Truist Financial Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 117 014 | −22,99 | 661 | −11,51 | ||||

| 2025-05-09 | 13F | Deutsche Bank Ag\ | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17 527 | 0,00 | 94 | 2,17 | ||||

| 2025-06-25 | NP | PRNT - The 3D Printing ETF | 615 580 | 28,92 | 3 164 | −20,92 | ||||

| 2025-08-14 | 13F | Disciplined Growth Investors Inc /mn | 1 890 920 | 0,83 | 10 684 | 15,79 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 14 764 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Sei Investments Co | 25 670 | 0,00 | 181 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Fmr Llc | 6 673 | 0,00 | 38 | 15,63 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 600 | −97,63 | 0 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 34 000 | −3,13 | 0 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | −100,00 | 0 | |||||

| 2025-06-03 | 13F | CWM Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 26 609 | 150 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 349 297 | −0,28 | 1 974 | 14,51 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 200 007 | 0,00 | 1 130 | 14,84 | ||||

| 2025-08-29 | NP | WMMAX - Teton Westwood Mighty Mites Fund Class A | 10 000 | 0,00 | 56 | 14,29 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 81 | 0,00 | 0 | |||||

| 2025-07-24 | NP | FCAJX - Fidelity Climate Action Fund Fidelity Advisor Climate Action Fund: Class A | 6 673 | 0,00 | 36 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-06-30 | NP | BULD - Pacer BlueStar Engineering the Future ETF | 2 199 | 53,03 | 11 | −8,33 | ||||

| 2025-08-08 | 13F | Candriam Luxembourg S.C.A. | 10 000 | 57 | ||||||

| 2025-07-28 | NP | QQQS - Invesco NASDAQ Future Gen 200 ETF | 8 011 | 31,61 | 43 | 34,38 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | AMH Equity Ltd | 207 661 | 88,78 | 1 173 | 116,82 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | C M Bidwell & Associates Ltd | 53 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Teton Advisors, Inc. | 10 000 | 0,00 | 56 | 14,29 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 2 039 | 39,09 | 12 | 57,14 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4 140 | 0,00 | 23 | 15,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 169 583 | 91,04 | 958 | 119,72 | ||||

| 2025-08-13 | 13F | Roubaix Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 566 508 | 28,59 | 3 201 | 47,67 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 693 | 17,20 | 21 | 33,33 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 33 271 | −38,72 | 188 | −29,96 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 17 271 | −1,57 | 98 | 12,79 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 80 300 | 454 | |||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Renaissance Group Llc | 236 879 | −11,42 | 1 338 | 1,75 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 19 407 | 27,80 | 110 | 47,30 |